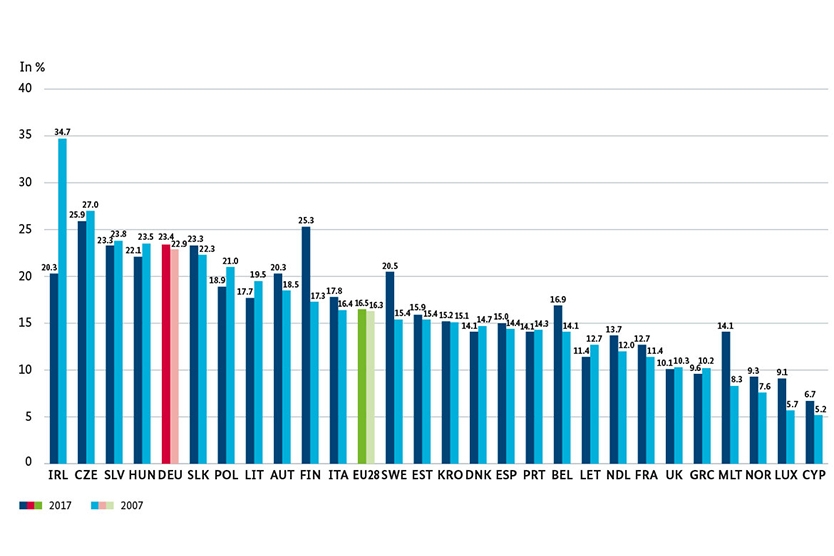

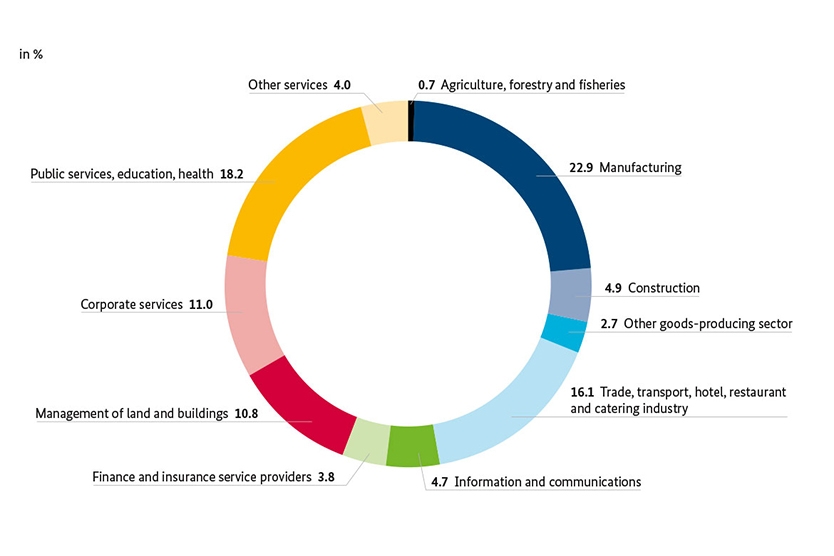

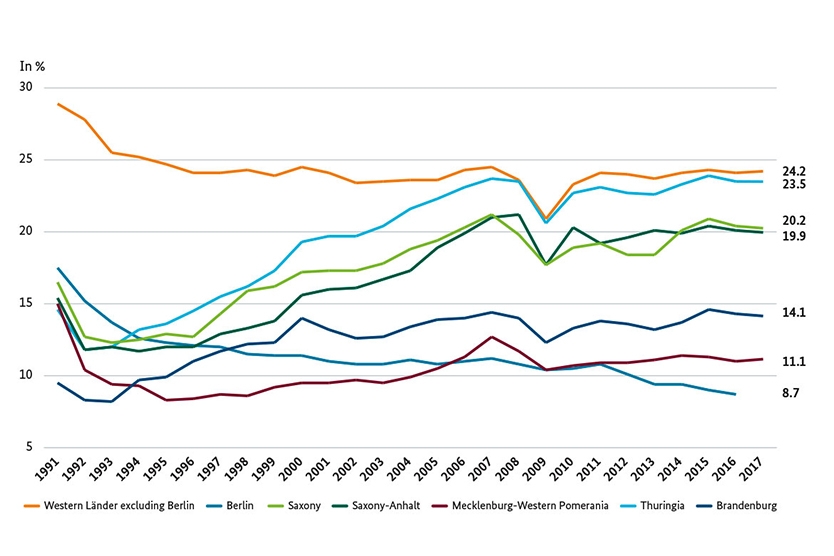

The proportion of gross value added delivered by manufacturing has been fairly steady for the last 20 years, amounting to 22.9 % in 2017. In contrast, industry only accounted for 16.3 % of gross value added in the overall EU in 2016; in leading industrial nations like France and Britain, it was actually much lower (cf. Diagram).

Regional clusters, strong SMEs

The comparatively great significance of industry in Germany is a reflection of the traditional specialisation in the German economy due to specific advantages. These include the regional clusters of efficient small, medium-sized and large firms and research establishments, and the availability of highly qualified workers and engineers.

| The largest industrial sectors in 2017 | ||

| Sector | Turnover (in € billion) | 1,000 employees |

| Automotive industry | 425 | 841 |

| Mechanical engineering | 252 | 1046 |

| Metal industry | 224 | 933 |

| Chemical/pharmaceutical industry | 196 | 453 |

| Electrical industry | 181 | 726 |

| Food industry | 180 | 596 |

Reference: Federal Statistical Office (only including companies employing 20-plus people, apart from construction industry proper)

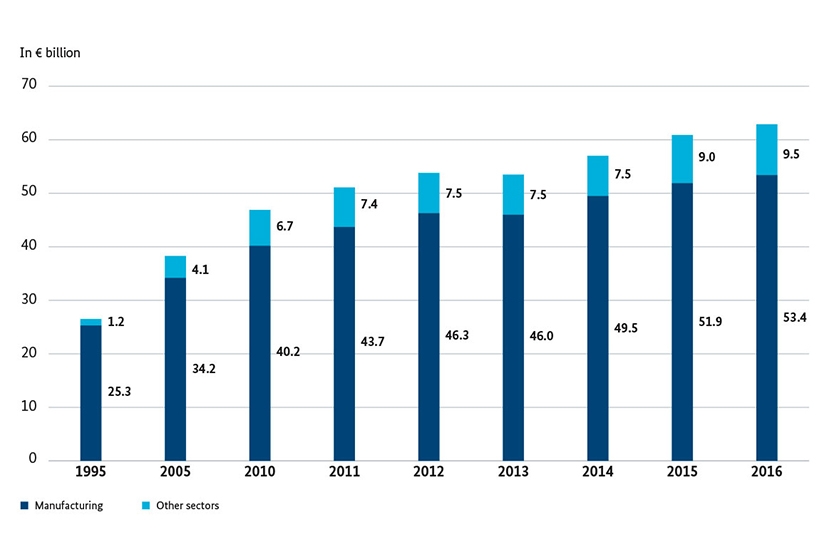

A strong exporter

Germany is one of the most successful exporters in the world. In 2017, the country exported goods worth €1,279 billion (+6.2% more than in 2016). The balance of trade attained a record surplus (€245 billion). This strong export performance is mainly due to the efficiency of the German industrial sector. The manufacturing sector sold almost 50 per cent of its output to customers outside Germany, but the significance of foreign trade is even greater in many other sectors: In 2017, the export ratio was just under 67 per cent in the pharmaceuticals industry, more than 62 per cent in the German automotive industry, and around 56 per cent in mechanical engineering.

| The world’s leading exporters and importers of goods in 2017 (share of global export/import of goods) | |||

| China | 12.8 % | USA | 13.4 % |

| USA | 8.7 % | China | 10.2 % |

| Germany | 8.2 % | Germany | 6.5 % |

| Japan | 3.9 % | Japan | 3.7 % |

| Netherlands | 3.7 % | United Kingdom | 3.6 % |

| South Korea | 3.2 | France | 3.5 % |

| Hong Kong | 3.1 % | Hong Kong | 3.3 % |

| France | 3.0 % | Netherlands | 3.2 % |

| Italy | 2.9 % | Netherlands | 3.2 % |

| United Kingdom | 2.5 % | South Korea | 2.7 % |

Source: WTO

Industry-related services increasingly prominent

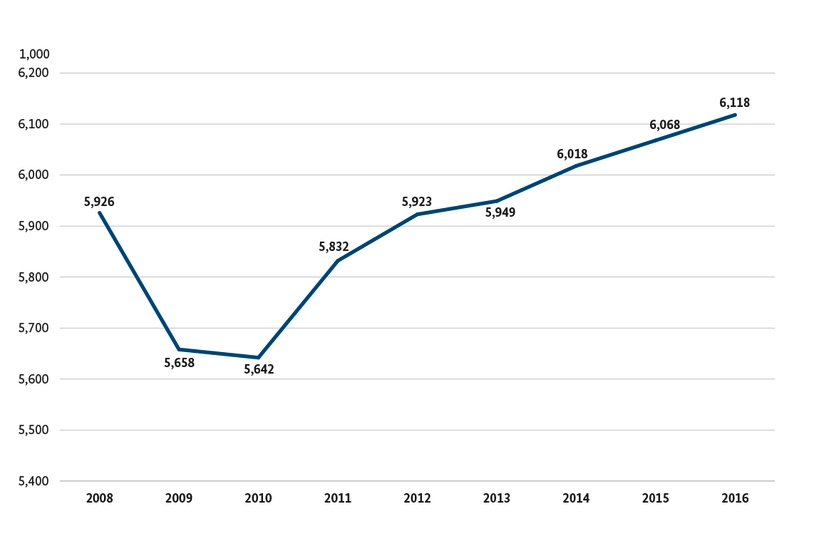

The structure of the German economy has changed radically over recent decades. Whilst in 1970 half the workforce worked in manufacturing, the figure today is only 19%. Also, the share of gross value added accounted for by industry was 36.5% back in 1970 and then declined for many years; however, this development has come to a halt since the mid-1990s. In 2017, the share of gross value added accounted for by industry was 22.9% in Germany – much higher than in comparable industrial nations.

These shifts are not a reflection of a decline in the importance of industry, but are mainly the result of fundamental changes in the value creation process, in which company-related and product-related services are playing an increasing role. This development means that the share of value creation does not fully reflect the actual economic significance of industry. With its strong demand for services, industry makes an important contribution towards the development of this sector. Service providers are increasingly becoming upstream suppliers for industry, and product-related services are growing in significance in the marketing of industrial products and facilities.