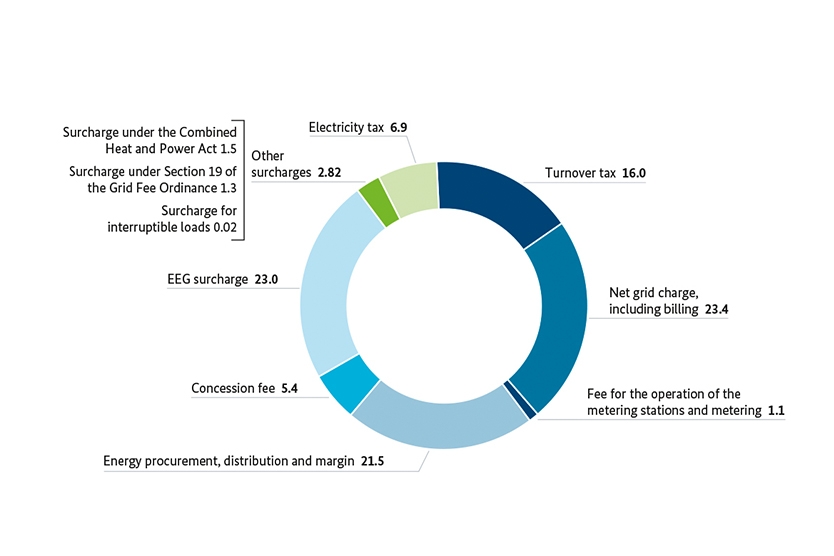

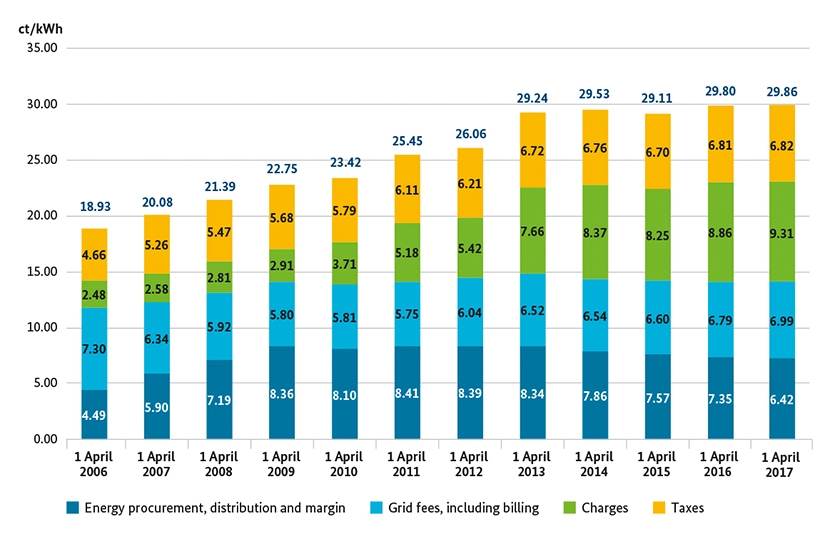

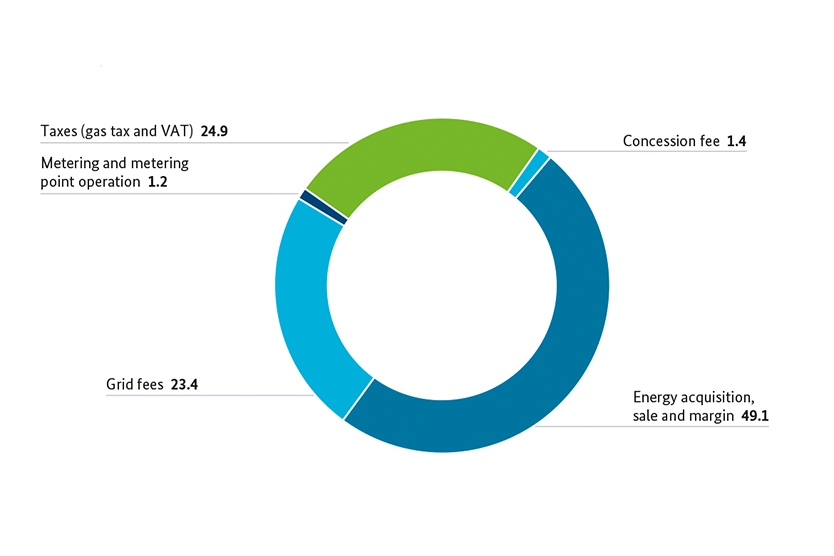

The electricity prices that residential customers pay include the costs for the acquisition and sale of the electricity, and the fees for using the electricity grid. On top of this come state-imposed price components. Many of them have fallen in recent years. These components may be described as “state-imposed”, but they rarely go directly into the government budget. The state-imposed price components serve a wide range of different purposes and are levied in different ways. In the following section, each individual state-imposed component will therefore be looked at in more detail:

1. EEG surcharge

The EEG surcharge (renewables surcharge) finances the expansion of renewables. It provides the money to pay for the funding of electricity from wind, solar and biomass. It has made the rapid expansion of renewables possible by providing a reliable financial base for more than 15 years.

Under the Renewable Energy Sources Act (in German), power plant operators receive remuneration rates set for 20 years for renewable power that they generate and feed into the grid. The tariff is paid by a transmission system operator (TSO), who sells the electricity on the exchange. The price they can obtain there often lies below the fixed remuneration rates. The difference between the spending on the remuneration and the revenues from selling the electricity is passed on to the electricity consumers. The resulting figure is the EEG surcharge.

Since 2014, operators of larger installations generating electricity from renewable energy, with a capacity of more than 100 kW, have had to market their own electricity and sell it on the electricity market. The TSOs no longer pay them fixed remuneration, but only a market premium for each kilowatt-hour they feed in. The market premium compensates for the difference between the value to be applied (previously called the “feed-in tariff”) and the average trading price for electricity, corrected for a few technical generation-related aspects.

Since 2017, the value to be applied has no longer been set by the state for large generating installations (photovoltaics or onshore wind with more than 750 kW capacity; biomass with more than 150 kW capacity, and offshore wind), but determined by competition in auctions. Generally, the lower the value to be applied contained in the bid, the more likely the bidder is to obtain funding – and the lower the market premium payments will be. These fall to zero if the average electricity price on the exchange reaches or even exceeds the value to be applied. This results in substantial falls in the cost of funding renewable energy.

Some parts of electricity consumption, e.g. in industry, are partially exempted from the payment of the EEG surcharge for reasons of competition. This partial exemption is necessary in order to maintain the competitiveness of these companies and to prevent industries from migrating to countries with lower climate protection standards (so-called carbon leakage). The partial exemption can vary depending on how energy-intensive the companies are. Every year, there are about 2,000 companies in the manufacturing sector that benefit from this rule. However, the vast majority of companies pay the full EEG surcharge. The private sector (industry, trade, commerce and services) contributes almost 50% of the financing of the EEG, private households about one third and public institutions the remaining share.

By 15 October of each year, Germany’s four transmission system operators set the EEG surcharge for the following year. To do this, they consult with recognised research institutions and prepare a sound, rigorous forecast of their expected expenses (remuneration and market premium payments) and their projected income from the sale of EEG power on the power exchange.

For 2019, the EEG surcharge has been set at 6.405 ct/kWh. This is 6% lower than the 2018 figure (6.792 ct/kWh). This means that the EEG surcharge has been cut in two successive years (2017: 6.880 ct/kWh). Find out more about the 2019 EEG surcharge here (PDF, 347KB) (in German).

2. CHP surcharge

The CHP surcharge was introduced in 2002 as part of the Combined Heat and Power Act.

Combined heat and power (CHP) plant operators can qualify to receive premiums for CHP power if they satisfy certain criteria. The KWK-G also grants premiums to promote the use of heating and cooling networks and accumulators in certain circumstances. The grid operator is initially responsible for paying the premiums. The costs are then evenly distributed among the TSOs via a cost equalisation mechanism. Most residential customers, for example, pay the CHP surcharge via their electricity bills as part of the charges for using the grid.

In 2020, the CHP surcharge for residential customers is 0.226 ct/kWh (compared with 0.280 ct/kWh in 2019, 0.438 ct/kWh in 2017 and 0.445 ct/KWh in 2016).

3. Surcharge under Section 19 (2) of the Electricity Grid Fee Ordinance

Final consumers can request an individual grid fee under Section 19 (2) Sentence 1 or Sentence 2 of the Electricity Grid Fee Ordinance (in German) if they meet certain criteria.

Individual grid fees can cause downstream operators of electricity distribution networks to lose revenues, however, and so transmission system operators must reimburse them for these losses. The transmission system operators are required to balance these reimbursements and their own lost revenues among themselves. The resulting lost revenues are charged to all final consumers proportionately as a "Section 19 StromNEV surcharge" on the network tariffs.

In 2019, the surcharge for residential customers is 0.305 ct/kWh (compared with 0.370 ct/kWh in 2018, 0.388 ct/KWh in 2017 and 0.378 ct/kWh in 2016).

4. Offshore surcharge under Section 17f of the Energy Industry Act (EnWG)

The offshore grid surcharge was introduced in 2013 in order to create a reliable framework for the expansion of offshore wind energy. This includes providing clarity on the extent to which plant operators can claim compensation from grid operators. Under Section 17f of the Energy Industry Act, grid operators can claim the costs of compensation paid for delays in connecting offshore plants to the grid or due to technical problems with these connections. A significant share of any costs of compensation must be paid by the operators of offshore wind farms and transmission system operators themselves. This ensures that the burden is shared fairly between TSOs, operators and consumers. In addition, the time during which a particular offshore wind farm receives compensation is deducted from the time during which this wind farm receives funding under the EEG at the end of the funding period.

From 2019, the costs of connecting offshore installations to the grid are being included in the surcharge for the first time, and will not be refinanced via the grid fees any more. So the costs are no longer a component of the grid fees, thus reducing those fees. Rather, the costs are identified transparently as a separate cost item via the surcharge.

In 2019, the surcharge for residential customers is 0.416 ct/kWh.

5. Section 18 of the Ordinance on Interruptible Loads (AbLaV)

The surcharge for interruptible loads has been levied on final consumers since 1 January 2014 and covers the costs of interruptible loads, which are used to maintain grid and system stability.

Under the ordinance, suppliers of interruptible loads are entitled to participate in auctions and offer their interruptible load capacity to transmission system operators. This is paid for by the transmission system operators.

The transmission system operators balance their costs amongst one another and finance them by passing them on to all final consumers through a surcharge of the same amount per kilowatt hour. The surcharge is set once a year and adjusted on 1 January. For 2019, the surcharge has been set at 0.005 ct/kWh (compared with 0.011 ct/kWh in 2018, 0.006 ct/kWh in 2017 and 0 ct/kWh in 2016).

A revised version of the ordinance entered into force on 1 October 2016.

6. Concession fee

Concession fees are paid by grid operators to municipalities for using municipal rights of way. The municipality and the grid operator enter into a formal agreement setting out the exact amount of the fees to be paid, with the maximum concession fee being specified in the Concession Fee Ordinance (KAV).

Concession fee caps on power supplied to standard-rate customers are based on municipality population numbers under Section 2 para. 2 KAV. They range from 1.32 ct/kWh for municipalities with up to 25,000 residents to as much as 2.39 ct/kWh for municipalities with more than 500,000 residents. According to the 2018 Monitoring Report published by the Bundesnetzagentur and the Bundeskartellamt, the average concession fee on power supplied to household customers was 1.61 ct/kWh (2017: 1.62 ct/kWh, 2016: 1.65 ct/kWh).

7. Electricity tax

In 1999, the Electricity Tax Act introduced a tax on electric power. It is to help achieve climate policy objectives by encouraging a more sparing use of electricity. It also serves to lower and stabilise pension contribution rates. Part of the tax revenue from the electricity tax goes toward reducing contribution rates for social security.

The tax is levied on electricity drawn from the public grid for consumption or on electricity that is generated and used by the consumers themselves. The tax is collected from either the utility or consumers, if these generate their own electricity. In most cases, electricity is drawn from the grid by a final consumer. If this is the case, the tax is owed by the utility providing the electricity. If the consumer themselves generate their own electricity, the tax will be levied from them. The customs administration is responsible for collecting the tax, which accrues to the federal budget.

The electricity tax on power supplied to household customers is 2.05 ct/kWh.

8. Value-Added Tax (VAT)

Items supplied by businesses to customers are generally subject to value-added tax. Under the 1994 German Value Added Tax Act, ‘items’ refer to not only products, but also services. The VAT is ultimately borne by the final consumer. The supplying company merely serves as a trustee: It collects VAT from customers and, since only businesses owe VAT, pays it over to the tax office.

VAT revenue is shared between the Federal, Länder and municipal governments based on formulas set out in the Fiscal Equalisation Act (FAG).

The VAT rate for electricity is 19% and is levied on the total amount made up of generation and sale, grid fees and other state-imposed price components.